Tax Receipts

used vehicles

Tax Receipts

used vehicles

Our Services

Stock control

A fully customized vehicle portfolio. Fully automated inventory tracking

Tax payment

Simplified process for the payment of the Corporate Tax (I.S.) on used vehicles.

Declaration of sale

Declare the sale of used vehicles and generate standardized invoices

Instant access to your stock, at any time and anywhere, pay the Minimum Tax and edit receipts and standardized invoices easily !

Discover

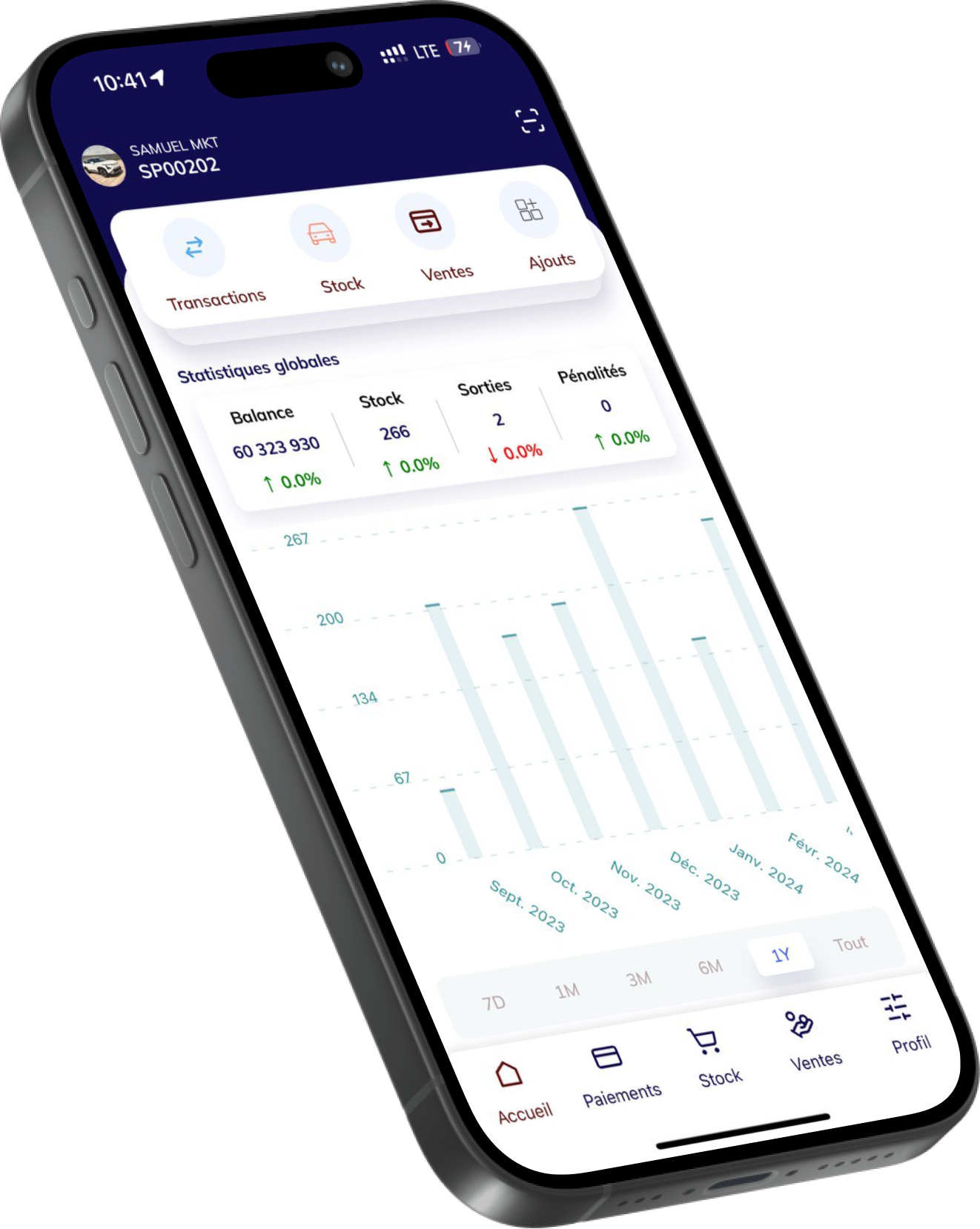

SesurMobile AppAPP

Download the mobile app and do your activities almost intuitively

Get Started

The operation of websesur in 4 steps :

Websesur membership can be done entirely online with the IFU and the identification and contact information. If you do not have an IFU number or if it is not up to date go to e-services.impots.bj

Then you can access your automatically updated stock and consult your unpaid and your regularized vehicles, as well as all the metrics of the state of your stock.

Select the vehicles to regularize and pay the Minimum Flat Tax then receive the standardized receipt, all instantly.

The websesur platform provides you with one more tool: the declaration of sale of your vehicles with downloadable standardized invoices.

If you want to know more, check out our guides.

1The Revenue Exploitation and Surveillance Company (SESUR).

We are Engaged to facilitating the management of your vehicle inventory, the declaration of sale and the payment of taxes, the edition of standardized invoices.

Downloads

App available for Android, Iphone and all devices.

Also available on the Amazon App Store and Gallery App Store.

is simple and intuitive.

Vehicle stock

Consult the stock of used vehicles and select the VINs for which you wish to adjust the minimum lump-sum tax

Pay online

Consult the price list and pay online

Receipt

Automatically generate the receipt

Latest News

Working visit to Benin: Patrice TALON and Emmanuel MACRON for an uncomplicated cooperation

Working visit to Benin: Patrice TALON and Emmanuel MACRON for an uncomplicated cooperation

FAQ's

All you need is your IFU. update on e-services.impots.bj And navigate to the login page and click on register. The process is simple!

The parameters used are the age (year of manufacture & year of import) of the vehicle and the taxpayer type of the importer registered with the DGI.

The payment of the tax is possible and in the regulations (without penalties) from your reception on your vehicle park until the sale

You can make your IMF payment with a mobile money transaction or by bank credit card with our main aggregators (Fedapay & Kkiapay).

Need immediate help? Call us at +229 51 72 22 22